How To Say Politely For Payment

adminse

Apr 06, 2025 · 9 min read

Table of Contents

The Art of Politely Requesting Payment: A Comprehensive Guide

What's the most effective way to request payment without damaging a business relationship?

Mastering the art of politely requesting payment is crucial for maintaining positive client relationships while ensuring timely revenue.

Editor’s Note: This comprehensive guide to politely requesting payment was published today, offering up-to-date strategies and best practices for businesses of all sizes.

Why Polite Payment Reminders Matter

In the business world, timely payment is the lifeblood of operations. However, chasing invoices can be a delicate dance. A poorly worded request can damage relationships and even lose clients. Conversely, a well-crafted approach safeguards your business's financial health while preserving valuable professional connections. This is particularly crucial in industries where long-term client relationships are paramount, such as consulting, design, and freelance work. The ability to request payment gracefully is a crucial skill that differentiates successful businesses from those struggling with cash flow. Late payments can lead to increased administrative costs, delayed projects, and ultimately, financial instability. Therefore, understanding how to navigate this sensitive topic effectively is essential for long-term success.

Overview of this Article

This article will explore various methods for politely requesting payment, from proactive strategies to handling overdue invoices. We'll cover different communication channels, the importance of professional tone and language, and effective strategies for preventing payment delays in the future. Readers will gain valuable insights into maintaining client relationships while ensuring their invoices are settled promptly and professionally.

Research and Effort Behind the Insights

This article draws upon years of experience in business management, client relations, and financial administration. We've analyzed numerous successful payment reminder strategies and consulted industry best practices to provide readers with a comprehensive and effective guide. The strategies discussed are grounded in practical application and real-world scenarios, ensuring their effectiveness in diverse business contexts.

Key Takeaways

| Key Aspect | Description |

|---|---|

| Proactive Communication | Establish clear payment terms upfront and maintain open communication throughout the project lifecycle. |

| Multiple Communication Channels | Utilize a variety of methods to reach clients, ensuring timely reminders without being overly intrusive. |

| Professional Tone & Language | Maintain a respectful and courteous tone, focusing on collaboration and mutual understanding. |

| Handling Overdue Payments | Implement a graduated approach, starting with gentle reminders and escalating only if necessary. |

| Preventing Future Delays | Proactively address potential issues, clarify expectations, and strengthen client communication. |

Let's dive deeper into the key aspects of politely requesting payment, starting with proactive communication.

Exploring the Key Aspects of Polite Payment Requests

-

Setting Clear Expectations from the Start: The foundation of successful payment collection lies in establishing crystal-clear payment terms from the outset. This includes specifying the payment method (e.g., bank transfer, credit card, invoice financing), the due date, and any applicable late payment penalties. Clearly stating these terms in a contract or proposal minimizes ambiguity and sets the stage for smooth transactions.

-

Multiple Communication Channels: Don't rely on a single method of communication. A multi-pronged approach is more effective. Begin with a formal invoice sent electronically (email is common, but consider other platforms depending on client preference). Follow up with a friendly email reminder a few days before the due date. If the invoice remains unpaid, consider a phone call (but ensure you have a script ready to maintain professionalism). For particularly unresponsive clients, a carefully worded physical letter might be necessary. The key is to escalate the approach gradually.

-

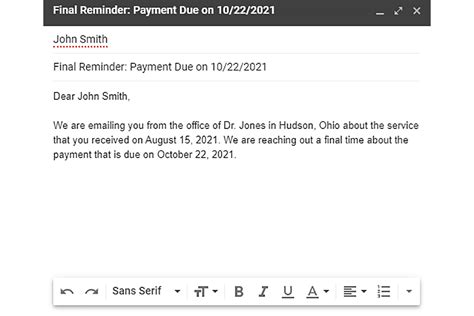

Professional Tone and Language: Maintain a consistently professional and respectful tone throughout all communications. Avoid accusatory or demanding language. Phrases like "We haven't yet received payment for invoice #…" or "A friendly reminder that invoice #… is due on…" are preferable to aggressive statements. Focus on maintaining a collaborative relationship and understanding the client's perspective. Offering flexibility or exploring payment plans might be appropriate in certain circumstances, especially for long-standing clients.

-

Handling Overdue Payments: Establish a clear process for handling overdue invoices. Start with a gentle reminder, offering a grace period. If the payment remains outstanding after the grace period, send a more formal reminder outlining the late payment penalty (if applicable). Only escalate to stronger measures, such as debt collection agencies, as a last resort. Every step should be documented for legal purposes.

-

Preventing Future Delays: Analyzing past payment delays can help identify patterns and implement preventative measures. Were there communication breakdowns? Were the payment terms unclear? Addressing these issues proactively strengthens client relationships and reduces future payment problems. Consider offering online payment options for greater convenience.

Closing Insights

Politely requesting payment isn't about confrontation; it's about proactive communication and relationship management. By combining clear expectations, multiple communication channels, and a professional approach, businesses can significantly improve their payment collection rates while maintaining positive client relationships. Consistent and clear communication, coupled with a willingness to work with clients facing genuine difficulties, forms the bedrock of successful payment management. The goal is not to alienate clients, but to ensure your business receives the payments it's rightfully owed in a timely and professional manner.

Exploring the Connection Between "Effective Communication" and "Politely Requesting Payment"

Effective communication is inextricably linked to politely requesting payment. Poor communication is often the root cause of late payments. Vague payment terms, infrequent updates on project progress, and a lack of follow-up all contribute to payment delays. Conversely, clear, proactive, and frequent communication minimizes misunderstandings and ensures that clients are aware of the payment schedule and any potential issues.

Roles and Real-World Examples:

- Client's Role: The client has a responsibility to understand and adhere to the agreed-upon payment terms. Ignoring invoices or delaying payment without explanation damages the relationship.

- Business's Role: The business has a responsibility to communicate clearly, proactively remind clients of payments, and offer flexible payment options when appropriate.

Risks and Mitigations:

-

Risk: Aggressive communication can damage client relationships and lead to lost business.

-

Mitigation: Use a professional and courteous tone in all communications, offering solutions rather than making demands.

-

Risk: Poorly documented payment terms can lead to disputes.

-

Mitigation: Clearly state payment terms in contracts and invoices, keeping detailed records of all communications.

Further Analysis of "Effective Communication"

Effective communication in the context of payment requests involves:

- Clarity: Ensure payment terms are unambiguous and easy to understand.

- Timeliness: Send payment reminders promptly and regularly, avoiding unnecessary delays.

- Professionalism: Maintain a courteous and respectful tone throughout all communications.

- Empathy: Attempt to understand the client's perspective, offering flexible payment options when appropriate.

- Documentation: Keep meticulous records of all communications and agreements.

Examples:

- A weekly progress report to a client, highlighting milestones achieved and upcoming tasks, subtly reinforcing the ongoing work and the upcoming invoice.

- A brief, friendly email a few days before the due date, confirming receipt of the invoice and asking if there are any questions.

- A phone call to discuss potential payment difficulties, exploring mutually agreeable solutions.

(Table illustrating effective communication strategies)

| Strategy | Description | Example |

|---|---|---|

| Clear Payment Terms | Explicitly state payment methods, due dates, and late payment penalties. | "Payment is due within 30 days of invoice date via bank transfer." |

| Proactive Reminders | Send reminders before the due date, not just after. | "Friendly reminder: Invoice #123 is due on [Date]." |

| Multiple Communication Channels | Utilize email, phone calls, and even physical mail when necessary. | Send an email reminder, followed by a phone call if no response is received. |

| Professional Tone | Maintain a courteous and respectful tone, even when dealing with late payments. | "We understand things can sometimes be overlooked; could you please remit payment?" |

| Flexible Payment Options | Consider payment plans or alternative payment methods if appropriate. | "We can discuss a payment plan if needed; please contact us to arrange this." |

FAQ Section

-

Q: What if a client ignores all my payment reminders? A: Escalate your approach gradually. Start with a more formal written reminder, then consider a phone call, and finally, if necessary, involve a debt collection agency. Document every step of the process.

-

Q: How often should I send payment reminders? A: A good rule of thumb is to send a reminder a few days before the due date, and then follow up a few days after the due date. The frequency might need to adjust based on your relationship with the client and their payment history.

-

Q: Should I offer a discount for early payment? A: This is a business decision. Offering an early payment discount can incentivize timely payments, but it also reduces your revenue. Weigh the pros and cons carefully.

-

Q: What payment methods should I offer? A: Offer a variety of convenient payment options, such as bank transfer, credit card payment, and online payment platforms.

-

Q: How do I handle a client who constantly pays late? A: Have a serious conversation with the client, outlining the impact of late payments on your business. Consider adjusting your terms, such as requiring upfront payments or deposits for future projects.

-

Q: What if I need to take legal action? A: Consult with a legal professional to understand your rights and options. Keep thorough documentation of all communications and agreements.

Practical Tips

- Use invoicing software: Streamline the process with automated invoicing and payment reminders.

- Clearly define payment terms: Avoid ambiguity by stating payment methods, due dates, and late payment penalties in your contracts and invoices.

- Send regular progress updates: Keeping clients informed about project progress strengthens the relationship and reinforces the importance of timely payment.

- Offer multiple payment options: Provide clients with various convenient ways to pay, such as online payment portals, bank transfers, and credit cards.

- Implement a clear escalation process: Establish a step-by-step approach for handling overdue invoices, starting with gentle reminders and progressing to stronger measures only if necessary.

- Maintain thorough records: Keep detailed records of all communications, invoices, and payment transactions.

- Consider early payment discounts: Incentivize prompt payment with a small discount for early settlement.

- Set up automatic payment reminders: Use invoicing software to automatically send reminders to clients before their payment due dates.

Final Conclusion

Politely requesting payment is a vital skill for any business. It requires a combination of proactive communication, clear expectations, and a professional approach. By implementing the strategies outlined in this guide, businesses can safeguard their financial health while maintaining positive relationships with their clients. Remember, the key is to build trust and collaboration, ensuring that the payment process is smooth, efficient, and respectful for all parties involved. Continuous refinement of your payment procedures, based on feedback and ongoing analysis of your clients' needs, will lead to a more streamlined and successful payment process. Regularly reviewing and updating your payment policies ensures they remain relevant and effective.

Latest Posts

Latest Posts

-

How To Say Luke In Chinese

Apr 07, 2025

-

How To Say A Boa Constrictor

Apr 07, 2025

-

How To Say Thank You Strongly

Apr 07, 2025

-

How To Say Life Goes On In Italian

Apr 07, 2025

-

How To Say Pinyin In English

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Say Politely For Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.